|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

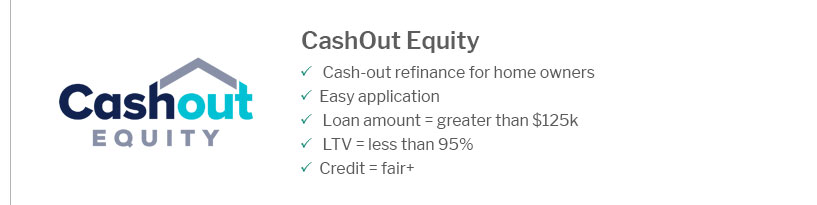

Exploring Cash Out Refinance or Home Equity Options for HomeownersHomeowners often face decisions regarding leveraging the value of their homes to access cash. Two popular options are cash out refinance and home equity loans. Each has its own set of advantages, drawbacks, and ideal scenarios for use. Understanding these can help homeowners make informed decisions. Understanding Cash Out RefinanceCash out refinancing involves replacing your current mortgage with a new, larger one. The difference between the old and new mortgage amounts is given to you in cash. Benefits of Cash Out Refinance

Considerations Before Refinancing

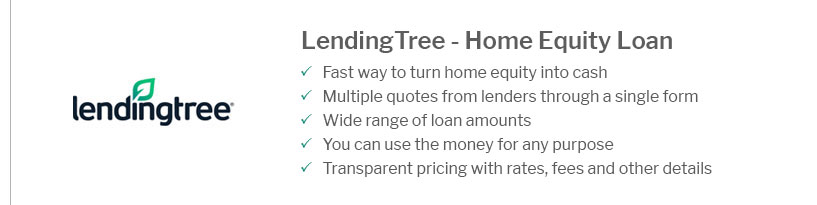

Home Equity LoansA home equity loan allows you to borrow against the equity in your home, with your house serving as collateral. Advantages of Home Equity Loans

Drawbacks of Home Equity Loans

Making the Right ChoiceChoosing between a cash out refinance and a home equity loan depends on various factors, including current interest rates, your financial goals, and how much equity you have built up in your home. Exploring the latest missouri refinance rates can provide valuable insights into the current market landscape. FAQ

https://www.youtube.com/watch?v=2yJPpdoX9ZE

Deciding between a HELOC (Home Equity Line of Credit) and a Cash Out Refinance can be challenging for homeowners. This video simplifies the ... https://www.quickenloans.com/learn/heloc-vs-cash-out-refi

Cash-out refinances and HELOCs are financial instruments that turn your equity into cash. However, they work in very different ways and have separate ... https://www.usbank.com/home-loans/home-equity/cash-out-refinance-vs-home-equity-loan.html

The repayment period for equity loans and refinances are flexible and can be extended as long as 30 years. With a HELOC, you can pay off the amount owed at any ...

|

|---|